Now Is The Time To Invest in a Gold IRA!

The experts say that we’re are slowly making our way through an economic recovery. That is tremendous news for people with long-term investments. However, those that lost lots of money during the most recent economic downturn may be filled with trepidation as far as figuring out way to grow back the funds that were lost. What’s more, people that are relatively new to the long-term investment game may be a little gun shy about deploying any investment strategy that goes beyond the realm of “let’s dump the minimum amount of money into my employer’s 401(k) plan and set automatically let it enroll in the safest plan possible.”

All of this behavior, of course, is understandable. As a whole, we took quite a financial bath during the latest recession. However, the behavior is the reason why it is more important than ever that a long-term investment strategy these days not only sells individuals on their potential growing power, but also on the level of investing confidence that a strategy can offer. And no strategy can accomplish this multi-pronged attack better than investing in a Gold IRA.

The experts say that we’re are slowly making our way through an economic recovery. That is tremendous news for people with long-term investments. However, those that lost lots of money during the most recent economic downturn may be filled with trepidation as far as figuring out way to grow back the funds that were lost. What’s more, people that are relatively new to the long-term investment game may be a little gun shy about deploying any investment strategy that goes beyond the realm of “let’s dump the minimum amount of money into my employer’s 401(k) plan and set automatically let it enroll in the safest plan possible.”

All of this behavior, of course, is understandable. As a whole, we took quite a financial bath during the latest recession. However, the behavior is the reason why it is more important than ever that a long-term investment strategy these days not only sells individuals on their potential growing power, but also on the level of investing confidence that a strategy can offer. And no strategy can accomplish this multi-pronged attack better than investing in a Gold IRA.

Gold IRA Facts

In essence, a Gold IRA is an Individualized Retirement Account (or IRA) that incorporates gold. Unlike other IRAs that solely deal with a person’s money, a Gold IRA is considered to be part of a special segment of IRAs that are known as a self-directed IRA. What this means is, a person with a self-directed IRA can invest in several non-monetary options in order to grow their account. These options include:

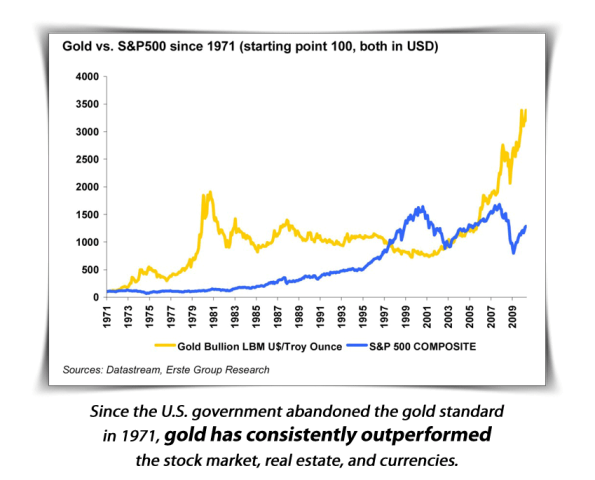

And amongst the self-directed IRA strategies a person can deploy, a Gold IRA stands out because of the metal’s inherent stability. It has a phenomenal track record of growth, and it’s this way because of its very nature. First off, it is a natural product and not a synthetic material. As such, a person investing in gold will not have to worry about it being devalued because of a sudden influx of newly manufactured product – an element that can cause inflation and subsequent devaluation of money. Secondly, the demand for gold around the world is incessant. From practical uses in the field of technology to personal exercises in vanity, gold’s versatility makes it a product that everyone wants. Because there is a finite amount of gold in the world, this inevitably drives up the price over time. Finally, gold is constant. It will can never be completely destroyed or degraded like other forms of currency, meaning that the gold that a person purchases today will be intact for centuries. We know this to be true, since gold coins and gold materials dredged from historic archeological excavations still looked like gold.

In essence, a Gold IRA is an Individualized Retirement Account (or IRA) that incorporates gold. Unlike other IRAs that solely deal with a person’s money, a Gold IRA is considered to be part of a special segment of IRAs that are known as a self-directed IRA. What this means is, a person with a self-directed IRA can invest in several non-monetary options in order to grow their account. These options include:

- Stocks

- Bonds

- Real estate

- Private equity

- Precious metals, such as silver, gold, and platinum

And amongst the self-directed IRA strategies a person can deploy, a Gold IRA stands out because of the metal’s inherent stability. It has a phenomenal track record of growth, and it’s this way because of its very nature. First off, it is a natural product and not a synthetic material. As such, a person investing in gold will not have to worry about it being devalued because of a sudden influx of newly manufactured product – an element that can cause inflation and subsequent devaluation of money. Secondly, the demand for gold around the world is incessant. From practical uses in the field of technology to personal exercises in vanity, gold’s versatility makes it a product that everyone wants. Because there is a finite amount of gold in the world, this inevitably drives up the price over time. Finally, gold is constant. It will can never be completely destroyed or degraded like other forms of currency, meaning that the gold that a person purchases today will be intact for centuries. We know this to be true, since gold coins and gold materials dredged from historic archeological excavations still looked like gold.

Rules and Regulations

When a person decides to rollover into a Gold IRA, the first thing they need to be aware of is that they will not receive any actual gold upon investment. Yes, the gold will be bought, but it will not be touchable until the investor either turns 59 ½ years old or they are willing to pay a severe penalty in order to access the metal – usually 10% if not more. In essence, these acts very much like a 401(k) or a traditional IRA, where a person cannot access the money that they invest in without penalty unless specific requirements have been satisfied.

Secondly, a person interested in a Gold IRA should be aware that taxes will eventually play a part in their investment. Specifically, any gold that is withdrawn from the account is considered taxable, and must be handled and treated as such. These taxes vary based on what age a person is when the gold is withdrawn.

Seeking Assistance

Finally, most experts state that a person seeking to invest in a Gold IRA should not go about it alone. Rather, a person should seek the assistance of a trustee in order to manage the account and to facilitate any transactions that a person may make with the entity that is selling the gold. This is nothing to be alarmed about; those that are nervous about bringing in a third party to handle their gold account should note that this notion is not all of that different than hiring a broker to oversee your other investment strategies. Indeed, companies like Regal Assistance have been in the game long enough to aid and assist you in making sure that your Gold IRA investment is handled properly and fairly, all while keeping you in the loop as to what is going on with your gold.

The use of a valued trustee is especially important because of how Gold IRAs are regulated. As one may imagine, the world of Gold IRAs attracts unscrupulous types that try and use the concept of the Gold IRA as a means of fraudulent behavior. As a result of this, the government has placed some pretty heavy regulations on how Gold IRAs can operate as a means to protect the investor; these regulations can sometimes be intimidating and overwhelming, to the point where an investor may feel the need to turn around and invest their funds elsewhere. However, a good and honorable trustee will be a big help in guiding the investor through all of the ins and outs of governmental regulations and what they can and cannot do with a Gold IRA. This knowledge will allow the investor to obtain a complete, well-rounded grasp of how the process works, thus enabling them to make the wisest financial decisions possible.

There are a few steps that any investor should take in order to find the proper trustee, of course. They can check their status with the Better Business Bureau. They can scour various review sites to view their pros and cons. They can take note of the kinds of services they offer, and the fees they charge for them. These steps will go a long way into maximizing an investor’s investment potential. They will also give the investor peace of mind along the way.

Ultimately, that is what a Gold IRA investment strategy can offer a person that not too many other long-term strategies can. Because of gold’s unwavering ability to increase in value over time, the IRA that bears its name will spare the investor the total financial chaos that has the potential to plague other strategies, as some investors learned the hard way not all that long ago. It is set up to assist a person looking to recoup some of the funds that were depleted, and it is set up to help out a newbie just figuring out how to traverse the often confusing landscape of investing. It can do both because it offers stability above all else. As society begins to heal the deep wounds that were forged within their wallets and purses over the past few years, this sense of financial normalcy is something that is important to hold onto, both in the near future and in the years and decades to come.

When a person decides to rollover into a Gold IRA, the first thing they need to be aware of is that they will not receive any actual gold upon investment. Yes, the gold will be bought, but it will not be touchable until the investor either turns 59 ½ years old or they are willing to pay a severe penalty in order to access the metal – usually 10% if not more. In essence, these acts very much like a 401(k) or a traditional IRA, where a person cannot access the money that they invest in without penalty unless specific requirements have been satisfied.

Secondly, a person interested in a Gold IRA should be aware that taxes will eventually play a part in their investment. Specifically, any gold that is withdrawn from the account is considered taxable, and must be handled and treated as such. These taxes vary based on what age a person is when the gold is withdrawn.

Seeking Assistance

Finally, most experts state that a person seeking to invest in a Gold IRA should not go about it alone. Rather, a person should seek the assistance of a trustee in order to manage the account and to facilitate any transactions that a person may make with the entity that is selling the gold. This is nothing to be alarmed about; those that are nervous about bringing in a third party to handle their gold account should note that this notion is not all of that different than hiring a broker to oversee your other investment strategies. Indeed, companies like Regal Assistance have been in the game long enough to aid and assist you in making sure that your Gold IRA investment is handled properly and fairly, all while keeping you in the loop as to what is going on with your gold.

The use of a valued trustee is especially important because of how Gold IRAs are regulated. As one may imagine, the world of Gold IRAs attracts unscrupulous types that try and use the concept of the Gold IRA as a means of fraudulent behavior. As a result of this, the government has placed some pretty heavy regulations on how Gold IRAs can operate as a means to protect the investor; these regulations can sometimes be intimidating and overwhelming, to the point where an investor may feel the need to turn around and invest their funds elsewhere. However, a good and honorable trustee will be a big help in guiding the investor through all of the ins and outs of governmental regulations and what they can and cannot do with a Gold IRA. This knowledge will allow the investor to obtain a complete, well-rounded grasp of how the process works, thus enabling them to make the wisest financial decisions possible.

There are a few steps that any investor should take in order to find the proper trustee, of course. They can check their status with the Better Business Bureau. They can scour various review sites to view their pros and cons. They can take note of the kinds of services they offer, and the fees they charge for them. These steps will go a long way into maximizing an investor’s investment potential. They will also give the investor peace of mind along the way.

Ultimately, that is what a Gold IRA investment strategy can offer a person that not too many other long-term strategies can. Because of gold’s unwavering ability to increase in value over time, the IRA that bears its name will spare the investor the total financial chaos that has the potential to plague other strategies, as some investors learned the hard way not all that long ago. It is set up to assist a person looking to recoup some of the funds that were depleted, and it is set up to help out a newbie just figuring out how to traverse the often confusing landscape of investing. It can do both because it offers stability above all else. As society begins to heal the deep wounds that were forged within their wallets and purses over the past few years, this sense of financial normalcy is something that is important to hold onto, both in the near future and in the years and decades to come.

RSS Feed

RSS Feed